Alerts

MEETING YOUR NEEDS: RAND & SWEET LLC

For over a century, Waldron Rand has offered a full range of tax, accounting, and business advisory services. Our experienced team collaborates closely with businesses (domestic and international) and high-net-worth individuals, providing technical expertise and trusted guidance. We are singularly focused on providing the best service and expertise to our clients.

Over the years, our clients have increasingly turned to us for assistance with the accounting functions that enable them to run their businesses effectively, such as accurate and dependable bookkeeping services, timely and actionable financial reporting, proactive cash flow management, budgeting, and forecasting. We also know that when our clients don’t have reliable financial records, it hampers our ability to provide strategic planning and compliance services in the most cost-efficient manner. At our clients’ request, we have taken a proactive approach and developed a curated solution.

We are excited to introduce Rand & Sweet – our joint venture company created specifically to meet our clients’ needs. As a separate entity, Rand & Sweet offers dedicated accounting services ranging from day-to-day bookkeeping to strategic CFO advisory services. While independent, Rand & Sweet maintains the same commitment to excellence and client service that have defined Waldron Rand’s legacy.

You can learn more about Rand & Sweet’s specialized services here:

Learn more about Rand & Sweet LLC

KEEPING YOU APPRISED

ONE BIG BEAUTIFUL BILL ACT (OBBBA) RESOURCES

The One Big Beautiful Bill Act (OBBBA) was signed into law on July 4, 2025. We are currently finalizing our year-end planning client letter, which will include various tax planning strategies to consider in light of the new law. For clients where more individualized planning is helpful, we are working through modeling and planning around the impact of the OBBBA on their specific tax situation. If you’d like some additional background on the key provisions of the new law, here are three resources we have available for you:

WATCH the hour-long recording of the webinar on the OBBBA we co-hosted with our colleagues at Partridge, Snow, and Hahn, LLC.

REVIEW the slides we shared during the webinar for a more focused review of the content.

READ a summary of the OBBBA in our news section, which covers bonus depreciation, opportunity zones, qualified small business stock, estate tax changes, state and local tax deductions (SALT cap), and treatment of research and development costs.

TRANSITION TO ELECTRONIC PAYMENTS

The Treasury Department is phasing out the use of paper checks for federal transactions. This includes both payments from the government—such as tax refunds and Social Security benefits—and payments to the government, such as estimated tax payments sent to the IRS. Although September 30, 2025, had been identified as a target date for initial stages of this change, the Treasury is expected to issue a detailed plan outlining the implementation schedule and any exceptions.

What this means: If you currently receive or submit government payments by paper check and haven’t yet transitioned to electronic methods, you may want to consider making this change when convenient. The transition is expected to be gradual, and we will keep you updated as additional guidance becomes available.

For questions, please reach out to your Waldron Rand team member.

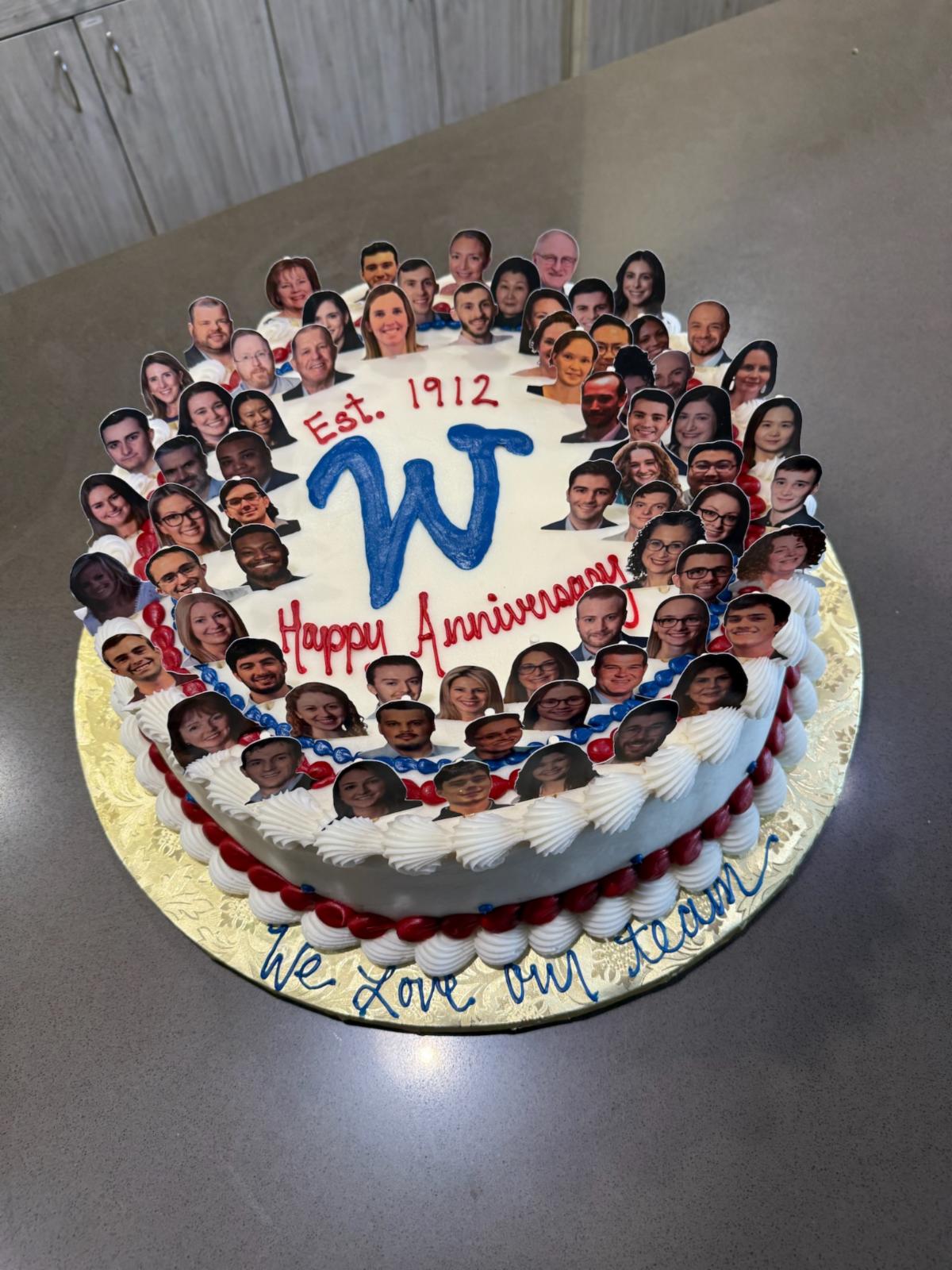

CELEBRATING OUR 113th ANNIVERSARY

| This month marks another milestone in Waldron Rand’s history as we continue the commitment to exceptional service that began in 1912 and has grown steadily over the decades. We’re proud to share some highlights of our journey with you.

Our Growth Over Time: Throughout our 113-year history, we have successfully navigated shifts in the economic landscape and industry trends while many of our peers succumbed to mergers or acquisitions. In an era of consolidation, we have remained proudly independent, guided by our commitment to personal relationships and trusted advice. Over 75 professionals build their careers here, with over 50% of employees having been with Waldron Rand for more than five years, and many celebrating decades of service. In the last 10 years, we’ve grown our leadership team by eight shareholders, almost all of whom initially joined us as associates. Additionally, we expanded our international resources as a member of MOORE, which provides a peer group dedicated to supporting our clients’ needs across the globe. Our growth allows us to sustain our founder’s vision of proactively anticipating our clients’ needs and maintaining the level of personal service to which our clients are accustomed. |

From individual tax preparation to complex business advisory services, we offer a full spectrum of accounting and financial services to meet your evolving needs. Waldron Rand specializes in Assurance, Taxation, Business Advisory, Estate Planning, and Trust Administration, along with our new joint venture offering Client Accounting Services (see above!) Thank you for being part of the Waldron Rand family. We look forward to working with you for many years to come. |

For over 110 years, Waldron Rand has focused on providing exceptional service to our clients. To this end, we are pleased to announce our new joint venture, Rand & Sweet LLC, significantly enhancing our ability to provide clients with outsourced accounting, bookkeeping, and CFO advisory services.

Available services through Rand & Sweet LLC include:

- Comprehensive bookkeeping and general ledger management

- Outsourced controller and CFO services

- Accounts payable management (bill payment, vendor management, reconciliations)

- Accounts receivable management (invoicing, collections support, reconciliations)

- Cash flow planning and budgeting

- Monthly, quarterly, and annual financial reporting

This joint venture allows us to provide seamless services — ranging from business formation to day-to-day bookkeeping to executive-level financial guidance — all while maintaining the personalized attention and deep expertise you expect from Waldron Rand.

We look forward to introducing you to this exciting extension of our capabilities.

Visit Rand & Sweet LLC to learn more or reach out to your Waldron Rand team with questions.

The webinar will focus on strategic tax planning opportunities that impact high-net-worth individuals, businesses, and tax-exempt entities, and specifically cover Opportunity Zone investments, research cost relief, international tax provisions, and estate planning implications. The webinar includes experts from Waldron Rand and Partridge Snow and Hahn.

Join Waldron H. Rand & Company and Partridge Snow & Hahn LLP (PSH) on July 31st @ 10:30 a.m. EST for a 75-minute webinar on the One Big Beautiful Bill Act. The webinar will provide an overview of the tax provisions included in the bill, with a focus on strategic tax planning opportunities for high-net-worth individuals, businesses (domestic and international) and tax-exempt organizations.

One Big Beautiful Bill Act Webinar

July 31, 2025

10:30 am EST

Tax experts from Waldron Rand and Partridge Snow & Hahn will provide an overview of the key tax provisions and strategic planning opportunities of this Act that impact high-net-worth individuals, businesses, and tax-exempt organizations. Some of the topics we will cover include:

- Bonus depreciation

- Opportunity zones

- Qualified small business stock

- Estate tax changes

- State and local tax deductions (SALT cap)

- Treatment of research and development costs

The One Big Beautiful Bill Act (the “OBBBA” or the “Act”) was signed into law by President Trump on July 4, 2025. The full text of the OBBBA can be found here. This Act extends certain provisions of the 2017 Tax Cuts and Jobs Act (“TCJA”), modifies various deductions and credits, and introduces new tax provisions. Read below to see how these new changes could potentially affect you.

|

|

|

|

|

|

On March 21, 2025, FinCEN issued an interim final rule that officially removes the requirement for U.S. companies and U.S. persons to report beneficial ownership information (BOI) under the Corporate Transparency Act. This brings closure to a complex regulatory issue that has been evolving rapidly over the past several months.

Key points:

- All entities created in the United States are now exempt from BOI reporting requirements

- Only foreign entities registered to do business in the U.S., and their non-US beneficial owners, must still report

Please see FinCen’s release here.

If you have any questions about how this might affect your specific situation, please contact your Waldron Rand team member.

On March 2nd, the Treasury Department announced that not only will it suspend enforcement of Corporate Transparency Act beneficial ownership reporting requirements, but also that it will be issuing rules to narrow the scope to apply to foreign reporting companies only. See full press release: https://home.treasury.gov/news/press-releases/sb0038

On February 27th, 2025, FinCEN issued favorable guidance regarding the impending beneficial ownership information (BOI) report filing deadline, announcing that it will not issue any fines or penalties, or take any other enforcement action, against companies that are noncompliant by the current deadlines. See full release here.

Prior to March 21st, FinCEN plans to issue an interim rule clarifying extended BOI reporting deadlines. In addition, we anticipate that further modifications to this reporting requirement will be issued later this year, taking into account feedback from the business community.

We will continue to keep you informed as updated guidance is issued.

As you are aware from our previous alerts about the Corporate Transparency Act (CTA), the path towards implementation of this legislation has been marked by repeated legal challenges, reversals, and reinstatements.

On February 18, 2025, the U.S. District Court for the Eastern District of Texas lifted its preliminary injunction on the CTA’s Beneficial Ownership Information (BOI) reporting requirements. As a result, the reporting requirements are now back in effect. In response to this development, the Financial Crimes Enforcement Network (FinCEN) has issued new guidance extending the deadline to March 21, 2025 for most reporting companies.

That said, FinCEN has announced plans to assess further deadline modifications and intends to initiate a process to potentially revise the BOI reporting rule, with a focus on reducing the burden on lower-risk entities, including many small businesses. Additionally, legislation is quickly moving through Congress with the aim of further extending the deadline to January 1, 2026.

Although we are optimistic that there will be further developments prior to the March 21, 2025 filing deadline, you should be prepared to comply by that date if necessary.

Our firm is closely monitoring these developments and will continue to provide updates as new information becomes available. You can also stay abreast of the latest alerts on the FinCEN website.

In a roller-coaster of court decisions, The Corporate Transparency Act’s Beneficial Ownership Information (BOI) reporting requirement has once again been suspended following a recent federal court decision. This marks the second significant ruling on this matter in less than a week, highlighting the rapidly evolving nature of this legal situation.

On December 23, 2024, a panel of the U.S. Court of Appeals for the Fifth Circuit granted a stay of the district court’s preliminary injunction entered in the case of Texas Top Cop Shop, Inc. v. Garland, pending the outcome of the Department of the Treasury’s ongoing appeal of the district court’s order. FinCEN immediately issued an alert notifying the public of this ruling, and recognizing that reporting companies may have needed additional time to comply with beneficial ownership reporting requirements, FinCEN extended reporting deadlines. On December 26, 2024, however, a different panel of the U.S. Court of Appeals for the Fifth Circuit issued an order vacating the Court’s December 23, 2024 order granting a stay of the preliminary injunction. Accordingly, as of December 26, 2024, the injunction issued by the district court in Texas Top Cop Shop, Inc. v. Garland is in effect, and reporting companies are not currently required to file beneficial ownership information with FinCEN.

You can stay abreast of the latest alerts on the FinCEN website.

Further appellate and legislative review is expected. We will continue to monitor developments and provide updates. However, at this time, we recommend that you prepare to comply with the BOI reporting requirement.

On December 5th, 2024, we informed you of a temporary nationwide injunction to the Beneficial Ownership Reporting (BOI) provisions of the Corporate Transparency Act. On December 23rd, the 5th US Circuit Court of Appeals granted a stay of that injunction, effectively reinstating the original mandate. Given the burden for existing reporting entities to comply with this mandate with only days before the original January 1st deadline, FinCEN has extended that deadline to January 13, 2025. As such, reporting entities formed prior to January 1, 2024, have a filing deadline of January 13, 2025 to submit their initial BOI report.

Further appellate and legislative review is expected. We will continue to monitor developments and provide updates. However, at this time, we recommend that you prepare to comply with the BOI reporting requirement prior to the January 13th deadline.

Due to the sweeping impact of this development, appeals are expected to commence quickly, with a possible restoration of the original mandate. For those reporting companies that choose to defer their filing until a final ruling is issued, please continue to liaise with your legal counsel to determine your compliance responsibilities. We will also continue to monitor for updates and keep you informed of any developments.

You can read the full Memorandum Opinion and Order issued by Judge Mazzant here.

Key Implications

- Through this temporary injunction, the CTA’s reporting obligations are currently not required to be met by January 1, 2025.

- This ruling represents a significant setback for the implementation of the CTA, which was designed to enhance corporate transparency.

What’s Next

- The situation remains fluid as appeals are anticipated.

- Waldron Rand is keeping an eye on the case. We will update you once we learn more.

- If you want to learn more about the filing process, you can find information here.

A bipartisan proposal released on January 16th includes an extension of three pro-business tax provisions of the Tax Cuts and Jobs Act (TCJA). The proposed legislation would restore immediate research and development expensing and 100% bonus depreciation for qualified depreciable assets, as well as reverse the unfavorable change to the TCJA’s business interest limitation computation. Although there was no legislative fix before the end of the 2022 filing season, as many had hoped, this proposal would have a retroactive application. We are optimistic that this critical legislation, which also expands the child tax credit, could become law over the next few weeks. In the meantime, we are closely monitoring this legislation and will continue strategizing with our clients on an approach to navigating this uncertainty.

The Corporate Transparency Act (CTA) was enacted into law as part of the National Defense Act in 2021. It requires disclosing the beneficial ownership information (BOI) of certain entities from people who own or control a company. The CTA is not part of the tax code, but rather the Bank Secrecy Act. As such, BOI reports are filed with the Financial Crimes Enforcement Network (FinCEN) and not the IRS.

The onerous reporting under the CTA is currently mandatory (beginning January 1, 2024) and is expected to impact over 30 million businesses. While entities formed in 2024 need to file their initial report within 90 days of creation or registration, entities in existence prior to January 1, 2024, have until January 1, 2025, to get into compliance. However, there are active bills in Congress to delay this reporting requirement until 2026. We anticipate action to be taken soon on these bills and will keep you updated. In the meantime, as you have likely been hearing of this new requirement, we wanted to provide some additional background. Your corporate attorney will be best positioned to analyze your business’ filing requirements and assist with the submissions. However, please feel free to reach out to us with any questions.

Dedham, MA, January 2, 2024 – Waldron Rand is pleased to announce that Nina Bandera has become a new shareholder in the firm. Nina offers her deep background in tax and assurance services to a variety of privately held businesses and individuals.

Before joining Waldron Rand in 2014, Nina provided assurance services at a Boston based CPA firm.

Nina is a CPA and a member of the Massachusetts Society of Certified Public Accountants. She earned her undergraduate degree from Fairfield University’s Dolan School of Business and her master’s degree in accountancy from Bentley’s McCallum Graduate School of Business.

Dedham, MA June 1, 2023 – For over 110 years, Waldron Rand has built a reputation for delivering unparalleled business, tax, and assurance services to our clients.

Our most valuable assets are our team members—our success comes from our people. Today, Waldron Rand’s ability to deliver holistic accounting, auditing, and consulting services to businesses and individuals is even more powerful with the addition of a new member to our leadership team, Beth C. Grossman, CPA, JD.

Adding Beth to our team enables us to expand our depth and breadth in estate, gift, and fiduciary income tax compliance and planning. She has 15 years of estate planning and estate and trust administration experience.

Join us in welcoming Beth to the oldest continuing public accounting firm in the country.

Congratulations Beth!

MOORE NORTH AMERICA ANNOUNCES WALDRON H. RAND & COMPANY, P.C. AS THEIR NEWEST MEMBER

Moore North America

Moore North America (MNA) welcomes the addition of Waldron H. Rand & Company, P.C. to the MNA association. Waldron Rand joins the 30 member firms that makeup MNA with over 120 collective offices in the United States, Canada, and Mexico. MNA is a member firm of Moore Global, the eleventh-largest accounting network in the world.

Established over 110 years ago in Massachusetts, Waldron Rand is the oldest public accounting firm in the country. Waldron Rand’s eight partners and over 60 staff specialize in serving business and individual tax clients, many with international tax and reporting needs. Their time-tested success is built upon understanding the challenges of clients’ businesses and utilizing the intellectual capital of the entire firm to provide solutions that sustain profitability, continuity, and opportunity.

Ellen O’Sullivan, Executive Director of Moore North America, said about the addition of Waldron Rand: “We are thrilled to have Waldron Rand join Moore North America. Their deep-rooted history and proven record of innovative thinking make them the perfect accompaniment for our association as we strive to expand our service offerings both at home and globally. “

“Our recent membership with Moore North America connects Waldron Rand with other like-minded firms with robust domestic and international expertise. Membership brings value to our employees and clients through utilizing the deep resources across the association,” says Rick Dlugasch, Waldron Rand Shareholder.

Sharon Shaff, Waldron Rand Shareholder, elaborates, “Through our membership with Moore North America we gain access to Moore Global’s network of over 500 worldwide offices allowing us to offer incredible support for our clients’ growing international tax and accounting needs. The personal relationships developed across the organization are invaluable to providing the level of service that our clients have been benefitting from since 1912.”

Graham Tyler, Partner, Moore Kingston Smith LLP, and Moore Global Board Member, shared his thoughts: “Waldron Rand is an excellent firm that we have always enjoyed working with in the past and believe will be a very positive addition to the overall Moore family.”

About Moore North America

Moore North America is an association of accounting and consulting firms and a regional member of Moore Global Network Limited (MGNL). On a combined basis, Moore Global’s member revenue is $3.95 billion, making it the eleventh-largest accounting network in the world. MNA’s 30 member firms generate over $2.1 billion in the United States, Canada, and Mexico and have over 120 collective offices in most major North American markets, with 7 member firms on the INSIDE Public Accounting Top 100 Firms list. To learn more, visit: www.moore-na.com or follow us on LinkedIn.

About Waldron Rand

Waldron Rand provides accounting, auditing, tax, and advisory. The firm has vast experience helping start-ups navigate market entry challenges, assisting established organizations in an emergent business environment, working internationally on behalf of businesses and individuals, and guiding individuals through the challenge of changing tax laws. There are three areas of focus: Assurance, Taxation, and Business Advisory.

For more information, please contact:

Michelle Parsley

Moore North America

+1 949 887 3032 / mparsley@moore-na.com

The recently enacted Inflation Reduction Act of 2022 contains several new environment-related tax credits that are of interest to individuals and small businesses. The Act also extends and modifies some preexisting credits.

Extension, Increase, and Modifications of Nonbusiness Energy Property Credit

Before the enactment of the Act, you were allowed a personal credit for specified nonbusiness energy property expenditures. The credit applied only to property placed in service before January 1, 2022. Now you may take the credit for energy-efficient property placed in service before January 1, 2033.

Increased credit. The Act increases the credit for a tax year to an amount equal to 30% of the sum of (a) the amount paid or incurred by you for qualified energy efficiency improvements installed during that year, and (b) the amount of the residential energy property expenditures paid or incurred by you during that year. The credit is further increased for amounts spent for a home energy audit. The amount of the increase due to a home energy audit can’t exceed $150.

Annual limitation in lieu of lifetime limitation. The Act also repeals the lifetime credit limitation, and instead limits the allowable credit to $1,200 per taxpayer per year. In addition, there are annual limits of $600 for credits with respect to residential energy property expenditures, windows, and skylights, and $250 for any exterior door ($500 total for all exterior doors). Notwithstanding these limitations, a $2,000 annual limit applies with respect to amounts paid or incurred for specified heat pumps, heat pump water heaters, and biomass stoves and boilers.

Extension and Modification of Residential Clean-Energy Credit

Before the enactment of the Act, you were allowed a personal tax credit, known as the residential energy efficient property (REEP) credit, for solar electric, solar hot water, fuel cell, small wind energy, geothermal heat pump, and biomass fuel property installed in homes in years before 2024.

The Act makes the credit available for property installed in years before 2035. The Act also makes the credit available for qualified battery storage technology expenditures.

Extension, Increase, and Modifications of New Energy Efficient Home Credit

Before the enactment of the Act a New Energy Efficient Home Credit (NEEHC) was available to eligible contractors for qualified new energy efficient homes acquired by a homeowner before Jan. 1, 2022. A home had to satisfy specified energy saving requirements to qualify for the credit. The credit was either $1,000 or $2,000, depending on which energy efficiency requirements the home satisfied.

The Act makes the credit available for qualified new energy efficient homes acquired before January 1, 2033. The amount of the credit is increased, and can be $500, $1,000, $2,500, or $5,000, depending on which energy efficiency requirements the home satisfies and whether the construction of the home meets prevailing wage requirements.

New Clean-Vehicle Credit

Before the enactment of the Act, you could claim a credit for each new qualified plug-in electric drive motor vehicle (NQPEDMV) placed in service during the tax year.

The Act, among other things, retitles the NQPEDMV credit as the Clean Vehicle Credit and eliminates the limitation on the number of vehicles eligible for the credit. Also, final assembly of the vehicle must take place in North America.

No credit is allowed if the lesser of your modified adjusted gross income for the year of purchase or the preceding year exceeds $300,000 for a joint return or surviving spouse, $225,000 for a head of household, or $150,000 for others. In addition, no credit is allowed if the manufacturer’s suggested retail price for the vehicle is more than $55,000 ($80,000 for pickups, vans, or SUVs).

Finally, the way the credit is calculated is changing. The rules are complicated, but they place more emphasis on where the battery components (and critical minerals used in the battery) are sourced.

Credit for Previously Owned Clean Vehicles

A qualified buyer who acquires and places in service a previously owned clean vehicle after 2022 is allowed an income tax credit equal to the lesser of $4,000 or 30% of the vehicle’s sale price. No credit is allowed if the lesser of your modified adjusted gross income for the year of purchase or the preceding year exceeds $150,000 for a joint return or surviving spouse, $112,500 for a head of household, or $75,000 for others. In addition, the maximum price per vehicle is $25,000.

New Credit for Qualified Commercial Clean Vehicles

There is a new qualified commercial clean-vehicle credit for qualified vehicles acquired and placed in service after December 31, 2022.

The credit per vehicle is the lesser of: 1) 15% of the vehicle’s basis (30% for vehicles not powered by a gasoline or diesel engine) or 2) the “incremental cost” of the vehicle over the cost of a comparable vehicle powered solely by a gasoline or diesel engine. The maximum credit per vehicle is $7,500 for vehicles with gross vehicle weight ratings of less than 14,000 pounds, or $40,000 for heavier vehicles.

Increase in Qualified Small Business Payroll Tax Credit for Increasing Research Activities

Under pre-Inflation Reduction Act law, a “qualified small business” (QSB) with qualifying research expenses could elect to claim up to $250,000 of its credit for increasing research activities as a payroll tax credit against the employer’s share of Social Security tax.

Due to concerns that some small businesses may not have a large enough income tax liability to take advantage of the research credit, for tax years beginning after December 31, 2022, QSBs may apply an additional $250,000 in qualifying research expenses as a payroll tax credit against the employer share of Medicare. The credit can’t exceed the tax imposed for any calendar quarter, with unused amounts of the credit carried forward.

Extension of Incentives for Biodiesel, Renewable Diesel and Alternative Fuels

Under pre-Act law, you could claim a credit for sales and use of biodiesel and renewable diesel that you use in your trade or business or sold at retail and placed in the fuel tank of the buyer for such use and sales on or before December 31, 2022. Now you are permitted to claim a credit for sales and use of biodiesel and renewable diesel fuel, biodiesel fuel mixtures, alternative fuel, and alternative fuel mixtures on or before December 31, 2024.

You’re also now allowed to claim a refund of excise tax for use of 1) biodiesel fuel mixtures for a purpose other than for which they were sold or for resale of such mixtures on or before December 31, 2024, and 2) alternative fuel as that used in a motor vehicle or motorboat or as aviation fuel, for a purpose other than for which they were sold or for resale of such alternative fuel mixtures on or before December 31, 2024.

© 2022 Thomson Reuters/Tax & Accounting. All Rights Reserved.

The Dirty Dozen represents the worst of the worst tax scams.

Compiled annually, the “Dirty Dozen” lists a variety of common scams that taxpayers may encounter anytime but many of these schemes peak during filing season as people prepare their returns or hire someone to help with their taxes. Don’t fall prey.

For a detailed description of each scam, please refer to the list below:

- IR-2022-125, IRS wraps up 2022 “Dirty Dozen” scams list; agency urges taxpayers to watch out for tax avoidance strategies

- IR-2022-122, Dirty Dozen: IRS, Security Summit reiterate recent warning to tax professionals and other businesses of dangerous spear phishing attacks

- IR-2022-121, Dirty Dozen: Scammers use every trick in their communication arsenal to steal your identity, personal financial information, money and more

- IR-2022-119, Dirty Dozen: IRS urges anyone having trouble paying their taxes to avoid anyone claiming they can settle tax debt for pennies on the dollar, known as OIC mills

- IR-2022-117, IRS continues with Dirty Dozen this week, urging taxpayers to continue watching out for pandemic-related scams including theft of benefits and bogus social media posts

- IR-2022-113, IRS warns taxpayers of “Dirty Dozen” tax scams for 2022

Prior year information on the IRS Dirty Dozen:

- 2021 — IRS announces “Dirty Dozen” tax scams for 2021

- 2020 — IRS unveils “Dirty Dozen” list of tax scams for 2020; Americans urged to be vigilant to these threats during the pandemic and its aftermath

- 2019 — IRS concludes “Dirty Dozen” list of tax scams for 2019: Agency encourages taxpayers to remain vigilant year-round

- 2018 — IRS wraps up “Dirty Dozen” list of tax scams for 2018; Encourages taxpayers to remain vigilant

- 2017 — IRS Summarizes “Dirty Dozen” List of Tax Scams for 2017

- 2016 — IRS Wraps Up the “Dirty Dozen” List of Tax Scams for 2016

- 2015 — IRS Completes the “Dirty Dozen” Tax Scams for 2015

- 2014 — IRS Releases the “Dirty Dozen” Tax Scams for 2014

Published by the IRS: https://www.irs.gov/newsroom/dirty-dozen

On January 8, 2021, the U.S. Small Business Administration (SBA) released the Second Draw Borrower Application Form, SBA Form 2483-SD, for borrowers seeking a Second Draw PPP Loan.

IMPORTANT NOTE: Borrowers who previously returned some or all of their First Draw PPP Loan funds or did not accept the full amount will also need to submit a Borrower Application Form, SBA Form 2483.

The release of the applications came mere hours after the SBA announced that the portal to accept PPP loan applications will re-open for existing PPP borrowers the week of January 11th. To promote access to capital, only community financial institutions will be able to make Second Draw PPP Loans on Wednesday, January 13, 2021. The PPP will open to all participating lenders shortly thereafter.

Here’s what you need to know about Second Draw PPP Loans.

Eligibility

A borrower is generally eligible for a Second Draw PPP Loan if the borrower previously received a First Draw PPP Loan and has or will use the full amount, has no more than 300 employees,* and can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

*Exceptions in employee numbers apply for businesses in the Accommodation and Food Services sector (NAICS Code beginning with 72).

Alternative calculations are provided for applicants that were not in business for all of 2019 as follows:

- For entities not in business during the first and second quarters of 2019 but in operation during the third and fourth quarters of 2019, applicants must demonstrate that gross receipts in any quarter of 2020 were at least 25% lower than either the third or fourth quarters of 2019.

- For entities not in business during the first, second, and third quarters of 2019 but in operation during the fourth quarter of 2019, applicants must demonstrate that gross receipts in any quarter of 2020 were at least 25% lower than the fourth quarter of 2019.

- For entities not in business during 2019 but in operation on February 15, 2020, applicants must demonstrate that gross receipts in the second, third, or fourth quarter of 2020 were at least 25% lower than the first quarter of 2020.

Borrowing Capacity

For most applicants, the maximum loan amount of a Second Draw PPP Loan is 2.5x the average monthly 2019 or 2020 payroll costs up to $2 million. For borrowers in the Accommodation and Food Services sector, the maximum loan amount for a Second Draw PPP Loan is 3.5x the average monthly 2019 or 2020 payroll costs up to $2 million.

The following methodology, authorized by the Consolidated Appropriations Act, 2021 (the Act), will be useful for many applicants in calculating the loan amount.

Step 1: Aggregate payroll costs (defined below) from 2019 or 2020 for employees whose principal place of residence is the United States.

Step 2: Subtract any compensation paid to an employee in excess of $100,000 on an annualized basis, as prorated for the period during which the payments are made or the obligation to make the payments is incurred.

Step 3: Calculate average monthly payroll costs (divide the amount from Step 2 by 12).

Step 4: Multiply the average monthly payroll costs from Step 3 by 2.5 or 3.5 if the applicant operates in the Accommodation and Food Services sector.

Step 5: Determine the lessor of the result of Step 4 or $2 million.

Payroll costs consist of compensation to employees (whose principal place of residence is the United States) in the form of salary, wages, commissions, or similar compensation; cash tips or the equivalent (based on employer records of past tips or, in the absence of such records, a reasonable, good-faith employer estimate of such tips); payment for vacation, parental, family, medical, or sick leave (except those paid leave amounts for which a credit is allowed under Families First Coronavirus Response Act, Sections 7001 and 7003); allowance for separation or dismissal; payment for the provision of employee benefits (including insurance premiums) consisting of group healthcare coverage, group life, disability, vision, or dental insurance, and retirement benefits; payment of state and local taxes assessed on compensation of employees; and, for an independent contractor or sole proprietor, wage, commissions, income, or net earnings from self-employment or similar compensation.

Additional information on how to calculate maximum loan amounts (by business type) can be found in the Interim Final Rule on Paycheck Protection Program as Amended released on January 6, 2021.

Required Documentation for Payroll Costs

Generally, an applicant will be required to submit the following information:

- If the applicant is not self-employed, the applicant’s Form 941 (or other tax forms containing similar information) and state quarterly wage unemployment insurance tax reporting forms from each quarter in 2019 or 2020 (whichever was used to calculate payroll), as applicable, or equivalent payroll processor records, along with evidence of any retirement and employee group health, life, disability, vision and dental insurance contributions, must be provided. A partnership must also include its IRS Form 1065 K-1s.

- If the applicant is self-employed and has employees, the applicant’s 2019 or 2020 (whichever was used to calculate loan amount) IRS Form 1040 Schedule C, Form 941 (or other tax forms or equivalent payroll processor records containing similar information) and state quarterly wage unemployment insurance tax reporting forms from each quarter in 2019 or 2020 (whichever was used to calculate loan amount), as applicable, or equivalent payroll processor records, along with evidence of any retirement and employee group health, life, disability, vision and dental insurance contributions, if applicable, must be provided. A payroll statement or similar documentation from the pay period covering February 15, 2020 must be provided to establish the applicant was in operation on February 15, 2020.

- If the applicant is self-employed and does not have employees, the applicant must provide (a) its 2019 or 2020 (whichever was used to calculate loan amount) Form 1040 Schedule C, (b) a 2019 or 2020 (whichever was used to calculate loan amount) IRS Form 1099-MISC detailing nonemployee compensation received (box 7), invoice, bank statement, or book of record that establishes that the applicant is self-employed; and (c) a 2020 invoice, bank statement, or book of record to establish that the applicant was in operation on February 15, 2020.

However, the Interim Final Rule on Second Draw Loans released on January 6th provides administrative relief to applicants. It states that “[a]t the time an applicant submits its loan application form, it must submit the following (detailed above) unless the documentation was submitted to the lender for the First Draw PPP Loan (i.e., the applicant used calendar year 2019 figures to determine both its First Draw PPP Loan amount and its Second Draw PPP Loan amount, and the lender for the applicant’s Second Draw PPP Loan is the same as the lender that made the applicant’s First Draw PPP Loan).”

Lenders are still required to “[c]onfirm the dollar amount of average monthly payroll costs for 2019 or 2020 (whichever was used to calculate loan amount) by reviewing the payroll documentation submitted with the borrower’s application.” Therefore, we expect many lenders will require the submission of the payroll documentation noted above in order expedite application processing time.

Required Documentation for Gross Receipts

For loans with a principal amount greater than $150,000, sufficient documentation establishing that the applicant experienced a reduction in revenue must be provided at the time of application, which may include relevant tax forms, such as annual tax forms, or if relevant tax forms are not available, a copy of the applicant’s quarterly income statements or bank statements.

For loans with a principal amount of $150,000 or less, the applicant must submit documentation sufficient to establish that the applicant experienced a reduction in revenue at the time of application, on or before the date the borrower submits an application for loan forgiveness, or, if the borrower does not apply for loan forgiveness, at SBA’s request. Such documentation may include relevant tax forms, including annual tax forms, or, if relevant tax forms are not available, a copy of the applicant’s quarterly income statements or bank statements.

What’s Next

We expect participating lenders to accept applications across various formats and timeframes. Businesses should consider where to apply, evaluate eligibility, and gather the appropriate documentation for the respective application(s).

On January 8, 2021, the U.S. Small Business Administration (SBA) released the Borrower Application Form, SBA Form 2483, for businesses applying for a First Draw PPP Loan or requesting an increase in their First Draw PPP Loan. Existing borrowers seeking a Second Draw PPP Loan will need to submit the Second Draw Borrower Application Form, SBA Form 2483-SD.

Release of the applications came hours after the SBA announced that the portal to accept PPP loan applications will re-open for new borrowers and certain existing PPP borrowers the week of January 11th. To promote access to capital, only community financial institutions will be able to make First Draw PPP Loans on Monday, January 11th. The PPP will open to all participating lenders shortly thereafter.

Here’s what you need to know about First Draw PPP Loans.

Eligibility

Eligible small entities, that together with their affiliates (if applicable), have 500 or fewer employees, including nonprofits, veterans’ organizations, tribal concerns, self-employed individuals, sole proprietorships, and independent contractors can apply.* Entities with more than 500 employees in certain industries, that meet the SBA’s alternative size standard or size standards for those industries, can also apply.

*Exceptions in employee numbers apply for businesses in the Accommodation and Food Services sector (NAICS Code beginning with 72).

Existing PPP borrowers that did not receive loan forgiveness by December 27, 2020 may (1) reapply for a First Draw PPP Loan if they previously returned some or all of their First Draw PPP Loan funds, or (2) under certain circumstances, request to modify their First Draw PPP Loan amount if they previously did not accept the full amount for which they were eligible.

Borrowing Capacity

For most borrowers, the maximum loan amount of a First Draw PPP Loan is 2.5x the average monthly 2019 or 2020 payroll costs up to $10 million. For borrowers applying for an increase in their First Draw PPP Loan, the period used for calculating monthly payroll costs for the initial application will be used to determine borrowing capacity.

The following methodology, authorized by the Consolidated Appropriations Act, 2021 (the Act), will be most useful for many applicants.

Step 1: Aggregate payroll costs (defined below) from 2019 or 2020 for employees whose principal place of residence is the United States.

Step 2: Subtract any compensation paid to an employee in excess of $100,000 on an annualized basis, as prorated for the period during which the payments are made or the obligation to make the payments is incurred.

Step 3: Calculate average monthly payroll costs (divide the amount from Step 2 by 12).

Step 4: Multiply the average monthly payroll costs from Step 3 by 2.5.

Step 5: Add the outstanding amount of an Economic Injury Disaster Loan (EIDL) made between January 31, 2020 and April 3, 2020 that you seek to refinance. Do not include the amount of any “advance” under an EIDL COVID-19 loan (because it does not have to be repaid).

Payroll costs consist of compensation to employees (whose principal place of residence is the United States) in the form of salary, wages, commissions, or similar compensation; cash tips or the equivalent (based on employer records of past tips or, in the absence of such records, a reasonable, good-faith employer estimate of such tips); payment for vacation, parental, family, medical, or sick leave (except those paid leave amounts for which a credit is allowed under the Families First Coronavirus Response Act, Sections 7001 and 7003); allowance for separation or dismissal; payment for the provision of employee benefits (including insurance premiums) consisting of group healthcare coverage, group life, disability, vision, or dental insurance, and retirement benefits; payment of state and local taxes assessed on compensation of employees; and, for an independent contractor or sole proprietor, wage, commissions, income, or net earnings from self-employment or similar compensation.

Additional information on how to calculate maximum loan amounts (by business type) can be found in the Interim Final Rule on Paycheck Protection Program as Amended, released on January 6.

Required Documentation

Generally, an applicant will be required to submit the following information:

- If the applicant is not self-employed, the applicant’s Form 941 (or other tax forms containing similar information) and state quarterly wage unemployment insurance tax reporting forms from each quarter in 2019 or 2020 (whichever was used to calculate payroll), as applicable, or equivalent payroll processor records, along with evidence of any retirement and employee group health, life, disability, vision and dental insurance contributions, must be provided. A partnership must also include its IRS Form 1065 K-1s.

- If the applicant is self-employed and has employees, the applicant’s 2019 or 2020 (whichever was used to calculate loan amount) IRS Form 1040 Schedule C, Form 941 (or other tax forms or equivalent payroll processor records containing similar information) and state quarterly wage unemployment insurance tax reporting forms from each quarter in 2019 or 2020 (whichever was used to calculate loan amount), as applicable, or equivalent payroll processor records, along with evidence of any retirement and employee group health, life, disability, vision and dental insurance contributions, if applicable, must be provided. A payroll statement or similar documentation from the pay period that covered February 15, 2020 must be provided to establish the applicant was in operation on February 15, 2020.

- If the applicant is self-employed and does not have employees, the applicant must provide (a) its 2019 or 2020 (whichever was used to calculate loan amount) Form 1040 Schedule C, (b) a 2019 or 2020 (whichever was used to calculate loan amount) IRS Form 1099-MISC detailing nonemployee compensation received (box 7), invoice, bank statement, or book of record that establishes that the applicant is self-employed; and (c) a 2020 invoice, bank statement, or book of record to establish that the applicant was in operation on February 15, 2020.

$900 BILLION COVID RELIEF BILL

On December 27, 2020, the President signed the Consolidated Appropriations Act, 2021 (the CCA) into law. The CCA is a further legislative response to the coronavirus (COVID-19) pandemic. Some of the key provisions of the CCA impacting businesses and individuals include:

Enhancements to Employee Retention Credit (ERC)

Businesses that received a loan pursuant to the Paycheck Protection Program (PPP) are now eligible for the ERC. The ERC is designed to encourage businesses to retain their full-time employees through the pandemic and is a fully refundable tax credit for companies experiencing severe business disruptions due to COVID-19. The ERC can result in a substantial financial benefit for organizations. Initially set to expire on December 31st, the ERC is now available for wages paid through July 1, 2021.

Continuing Paycheck Protection Program (PPP) and Other Small Business Support

Clarifies that deductions are allowed for otherwise deductible expenses paid with the proceeds of a PPP loan that is forgiven.

Additional PPP funds available for second draw of loans for eligible small businesses.

Expansion of eligible expenses that can be used for PPP loan forgiveness.

Eligibility of 501(c)(6) Organizations for Loan Under the PPP

Expands eligibility of 501(c)(6) organizations with fewer than 300 employees and certain thresholds are met concerning lobbying receipts and activities.

Extension of CARES Act Unemployment Provisions

Includes a $300 supplement to all state and federal unemployment benefits starting December 26, 2020 to March 14, 2021.

Business Meals Temporarily 100% Deductible

The bill reverses previous limitations and provides a temporary full deduction of certain business meals. With this new legislation, meal expenses incurred after December 31, 2020 and before January 1, 2023 could be 100% deductible.

Additional 2020 Recovery Rebates

Provides a $600 refundable advanced tax credit to each eligible taxpayer.

Click here for a complete summary of the CCA.

MASSACHUSETTS TO PROVIDE $668 MILLION IN GRANTS FOR SMALL BUSINESS RELIEF

Governor Baker announced a $668 million small businesses relief fund through which eligible businesses may receive grant money of up to $75,000 for operating expenses.

The grants will be administered by the Massachusetts Growth Capital Corporation and applications will open Thursday, December 31. More information can be found on the Massachusetts Growth Capital Corporation website here.

On December 20, 2020, Congress agreed to terms of the Emergency COVID Relief Act of 2020 (the Act). The Act, which will provide an additional $900 billion of funds to stimulate the economy, includes significant changes to the Paycheck Protection Program (PPP). President Trump signed a one-day extension of government funding to prevent a government shutdown, enabling lawmakers to write the final text for the relief package.

To the satisfaction of many, three notable clarifications from prior guidance are included in the Act regarding the tax implications of PPP funds:

1) PPP loan forgiveness

2) PPP covered expenses

3) Owners’ basis for flow-thru entities

PPP Loan Forgiveness

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) implies that forgiveness of a PPP loan is non-taxable. While the terminology was inconsistent at times, wavering from forgiveness of indebtedness to excluded from gross income, the CARES Act and subsequent guidance reiterated that forgiveness will not create a taxable event. This Act reaffirms this position.

PPP Covered Expenses

Much of the PPP tax conversation has been focused on the treatment of covered expenses – payroll, utilities, rent, and interest as defined by Section 1106(b) of the CARES Act. Internal Revenue Service (IRS) Notice 2020-32 indicated that a borrower cannot deduct expenses paid with funds that create non-taxable income. The IRS then doubled down with the issuance of Revenue Ruling 2020-27 affirming their position that a taxpayer may not deduct those expenses in the taxable year in which the expenses were paid or incurred if, at the end of such taxable year, the taxpayer reasonably expects to receive forgiveness of the covered loan, even if the taxpayer has not applied for forgiveness of the covered loan by the end of such taxable year.

The Act significantly changes course for year-end tax planning. When referencing the covered expenses under the PPP, the Act states “no deductions shall be denied or reduced…by reason of the exclusion from gross income,” meaning the expenses ARE deductible.

Owners’ Basis for Flow-Thru Entities

Many of the tax implications questions were focused on the deductibility of expenses. The Act addressed such and also provided a welcomed clarification for owners of flow-thru entities (S corporations and LLCs/partnerships), especially after the additional limitations of PPP funds placed on owner compensation. The Act states “no basis increase shall be denied, by reason of the exclusion from gross income,” meaning PPP forgiveness will INCREASE basis.

A Closer Look

Considering the clarifications and trusting that the IRS will not impede the legislation, we have provided an example of how the changes could affect your loan forgiveness tax impact.

| EXAMPLE: | |

| Revenue | $5 million |

| Expenses | $ 6 million |

| Net Loss | ($1 million) |

| Add: PPP forgiveness amount | $1 million |

| Net Income | $ -0- |

| Less: non-taxable PPP forgiveness amount | $1 million |

| Taxable Loss | ($1 million) |

| Additional assumptions for LLC/partnership/S corporation: | |

| Tax basis of owner as of January 1, 2020 | $-0- |

| Owner distributions paid in 2020 | $-0- |

C corporations:

Corporations will have non-taxable income to the extent the PPP loan is forgiven and accounted for as such. All expenses paid will be fully deductible and all wages will count toward the computation of federal and state R&D tax credits.

This loss can now be carried back five years or carried forward indefinitely.

Depending on the previous taxable position of the company, this change could result in a big win for some corporations. Five years ago, income tax rates were much higher than they are today. If five years ago the company was in a 34% tax bracket and today at 21%, the result of this law is a 47% higher tax benefit

S corporations and LLCs/partnerships:

The big question since March related to flow-thru entities was whether an owner’s basis would increase or not. The clarified forgiveness amount, while not taxable, will increase basis.

To accompany the example above, consider an S corporation with one shareholder. The tax loss of $1 million might not have been allowed since the taxpayer is being allocated a $1 million tax loss and their basis was zero. However, since the law indicates that you will get basis for the forgiveness of the PPP loan, the taxpayer’s basis is now $1 million before the loss and the owner can use this basis on their individual income tax return, allowing them to deduct the $1 million loss against other income.

The challenge many flow-thru entities will have will relate to buy-out clauses. There could be unintended consequences from M&A transactions or when partners enter and leave an entity.

Self-employed individuals and farmers:

Similar to flow-thru entities, this legislation will allow individuals and farmers to claim the losses. There is a specific question on IRS Forms Schedules C and F which ask a question each taxpayer must answer: is ‘all or some’ investment at risk? Taxpayers can take the position that the forgiveness amount gives them basis to claim these losses now and can check the box in the affirmative.

Waldron Rand’s Take

Over the last few months we have been busy tax planning with our clients who expected to have their PPP loans forgiven, and each conversation hinged on a variable – what will taxable income be if the IRS and/or Congress react? We debated ordering rules, the impact on IRS Section 199A, R&D credits and the impact to owners of flow-thru entities.

The changes regarding deductibility provide answers to many of the questions and concerns we, along with borrowers and other practitioners, had. More importantly, these changes correct the unintended tax consequences of PPP funds and keep cash in the hands of the small businesses, magnifying the PPP impact.

Flow-thru entities should review their Operating Agreements and Shareholder Agreements to fully understand the impact PPP forgiveness may have on their business.

While significant, the clarification on the tax implications of PPP funds is just a small piece of the Act. For more updates and guidance on all things COVID-19, visit our alerts.

Tax Implications of PPP Funds Finally Align with Congressional Intent: Originally published by Aprio, LLP, an affiliate member of Morison KSi

Join us in welcoming our newest shareholder, Adam Remillard, to the oldest public accounting firm in the country. For 110 years, Waldron H. Rand & Company has built a reputation for delivering unparalleled business, tax, and assurance services and expertise to our clients. Our success comes from our people, and we are thrilled to welcome Adam to our leadership team.

Adam Remillard provides Waldron Rand clients with a deep background working with closely held businesses on their complete tax and financial needs. He has extensive experience working with privately held businesses and high net worth individuals, with particular expertise in real estate taxation. Adam’s clients benefit from his passionate, relationship based approach towards delivering proactive, thoughtful tax, and business advice.

Dear Client,

We hope this letter finds you and your family well.

2020 has been a complex year on many fronts, and the tax legislation is no exception. The Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed by Congress with overwhelming support and was signed into law by President Trump on March 27th, 2020. CARES was far-reaching and included substantial stimulus for businesses, particularly small businesses. Also, let us not forget about the massive Tax Cuts and Jobs Act (TCJA) that generally went into effect two years ago but still impacts tax planning. It is possible that there could be more tax law changes, in addition to the “unprecedented” events we have experienced this year.

Below is a reminder and brief overview of some of the significant changes that you should be aware of during the upcoming tax season and beyond, and actions you can take now.

ITEMIZED DEDUCTIONS

Previously, charitable contributions could only be deducted if taxpayers itemized their deductions. However, taxpayers who don’t itemize deductions may take a charitable deduction of up to $300 for cash contributions made in 2020 to qualifying organizations. For the purposes of this deduction, qualifying organizations are those that are religious, charitable, educational, scientific or literary in purpose.

The CARES Act also temporarily suspends limits on charitable contributions. Individuals who itemize their deductions may deduct qualified contributions of up to 100 percent of their adjusted gross income.

STANDARD DEDUCTION

The standard deduction has been increased in 2020 to $24,800 for married taxpayers filing jointly and $12,400 for single taxpayers. Married taxpayers over age 65 each have an additional $1,300 added to their standard deduction ($1,650 for an unmarried taxpayer).

NET OPERATING LOSS (NOL)

For NOLs that arise in 2018 and later tax years, the TCJA generally reduces the maximum amount of taxable income that can be offset with NOL deductions from 100% to 80%. In addition, the TCJA generally prohibits NOLs incurred in 2018 and later tax years from being carried back to an earlier tax year — but it allows them to be carried forward indefinitely (as opposed to the 20-year limit under pre-TCJA law). Under the CARES Act, taxpayers are now eligible to carry back NOLs arising in 2018 through 2020 tax years to the previous five tax years. The CARES Act also allows taxpayers to potentially claim an NOL deduction equal to 100% of taxable income for prior-year NOLs carried forward into tax years beginning before 2021.

Through 2025, the TCJA applies a limit to deductions for current year business losses incurred by noncorporate taxpayers. Such losses generally can’t offset more than $250,000 ($500,000 for married couples filing jointly) of income from other sources, such as salary, self-employment income, interest, dividends and capital gains. (The limit is annually adjusted for inflation.) “Excess” losses are carried forward to later tax years and can then be deducted under the NOL rules. The CARES Act temporarily eliminates the limitation. These taxpayers can now deduct 100% of business losses arising in 2018, 2019 and 2020. If any of these changes reduce your tax liability for 2018 or 2019, you may be able to file amended returns to receive a refund now.

BONUS DEPRECIATION

Prior to the TCJA, qualified retail improvement property, restaurant property and leasehold improvement property were depreciated over 15 years under the modified accelerated cost recovery system (MACRS). The TCJA classifies all of these property types as qualified improvement property (QIP).

Congress intended QIP placed in service after 2017 to have a 15-year MACRS recovery period and, in turn, qualify for 100% bonus depreciation. Bonus depreciation is additional first-year depreciation of 100% for qualified property placed in service through Dec. 31, 2022. For 2023 through 2026, bonus depreciation is scheduled to be gradually reduced.

However, the statutory language didn’t define QIP as 15-year property. Therefore, QIP defaulted to a 39-year recovery period, making it ineligible for bonus depreciation. The CARES Act corrected this drafting error. Taxpayers that have made qualified improvements during the past two years can claim an immediate tax refund for the bonus depreciation they missed. Taxpayers investing in QIP in 2020 and beyond also can claim bonus depreciation going forward, according to the phaseout schedule. In some cases, however, it might be more beneficial to claim depreciation over 15 years.

INTEREST DEDUCTION

Generally, under the TCJA, interest paid or accrued by a business is deductible only up to 30% of adjusted taxable income (ATI). Taxpayers with average annual gross receipts of $25 million or less for the three previous tax years generally are exempt from the limitation. Larger real property businesses can elect to continue to fully deduct their interest, but then they’re required to use the alternative depreciation system for real property used in the business.

The CARES Act increases the interest expense deduction limit to 50% of ATI for the 2019 and 2020 tax years. (Special partnership rules apply for 2019.) It also permits businesses to elect to use 2019 ATI, rather than 2020 ATI, for the 2020 calculation, which may increase the amount of the deduction. If these changes reduce your tax liability for 2019, you may be able to file an amended return to receive a refund now.

RETIREMENT PLANS

In response to the COVID-19 crisis, the CARES Act provides some temporary relief to retirement plan owners:

- Owners who need funds from their accounts to help them financially survive the crisis: The Act waives the 10% early withdrawal penalty — along with providing additional tax advantages that taxpayers age 59½ and older can also benefit from — on COVID-19-related distributions up to $100,000. These generally are 2020 withdrawals made by someone who has been (or whose family has been) infected with COVID-19 or who has been economically harmed by the virus. Distributions may be recontributed to the retirement plan over the three-year period starting the day after the withdrawal. If distributions aren’t recontributed, income tax payments can be spread out over three years. Many additional rules apply, so contact your tax advisor for details.

- Owners who don’t need funds from their accounts this year: The Act waives retirement plan required minimum distributions for 2020. This potentially allowed taxpayers to avoid having to sell plan investments during a down market.

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, signed into law in late 2019, makes a variety of tax law changes related to retirement plans.

Here are some key changes that could affect you:

- Allows penalty-free IRA withdrawals of up to $5,000 for the birth or adoption of a child,

- Repeals the maximum age of 70½ for making traditional IRA contributions,

- Increases the age for beginning required minimum distributions (RMDs) from age 70½ to age 72, for taxpayers who didn’t turn age 70½ before Jan. 1, 2020 (that is, were born after June 30, 1949), and

- Reduces the time period for taking IRA distributions to 10 years for beneficiaries — other than surviving spouses and certain others — inheriting IRAs after Dec. 31, 2019.

ESTATE AND GIFT TAXES

The lifetime estate and gift tax exclusions are increased to $11,580,000 per person. The annual gift tax exclusion remains $15,000 for 2020. Massachusetts still taxes estates over $1,000,000 and has no gift tax requirement.

IMPORTANT REMINDERS

- You should consider deferring income such as bonuses until 2021, as a way of deferring tax.

- Your long-term capital gains may be subject to a 0% tax rate if your taxable income for all income and long-term capital gains is below $80,000 for married filing jointly and $40,000 for single filers.

- You should consider converting your traditional IRA to a Roth IRA if you expect your adjusted gross income to be substantially lower in 2020. The conversion to the Roth IRA will increase your adjusted gross income.

- If your itemized deductions are not higher than the standard deduction, consider bunching deductions and charitable donations so they will be of value to you every other year.

- You should consider maximizing your contributions to your retirement plans such as a 401(k) or 403(b). You should also consider making contributions to a traditional or Roth IRA account if you qualify. If you are self-employed, you should consider setting up a SEP plan or Solo 401(k) account.

- Taxpayers over age 72 can make charitable donations directly from their Individual Retirement Accounts (IRAs) using their RMDs. Charitable donations made directly from IRAs are not taxable. This applies only to IRAs, not 401(k) plans.

IMPACT OF PRESIDENTIAL ELECTION

President-elect Joe Biden has announced a tax plan that departs significantly from the policies created under the Tax Cuts and Jobs Act of 2017 and other tax legislation passed during President Trump’s administration. Below are a few key takeaways from Biden’s proposals. Please keep in mind that the results of the runoff elections in Georgia, which will determine the Senate’s balance of power, will have a direct impact on the likelihood of any of these proposals becoming law. We will keep you informed of developments through our newsletter as this evolves.

- The top individual federal income tax rate would rise from 37% to the pre-Trump rate of 39.6%.

- The corporate rate would rise from 21% to 28%; a 15% alternative minimum tax would apply to corporate book income of $100 million and higher.

- Individuals earning $400,000 or more would pay additional payroll taxes.

- The maximum Child and Dependent Tax Credit would rise from $3,000 to $8,000 ($16,000 for more than one dependent).

- Tax relief would be offered for student debt forgiveness and the first-time homebuyer credit would be restored.

- The estate tax exemption would drop by about 50%.

Please contact us so we can evaluate your situation and develop a strategy that meets your needs.

Wishing you a happy and healthy holiday season!

Your team at Waldron Rand

April 24, 2020 -The President just signed The Paycheck Protection Program and Health Care Enhancement Act, a new law that augments the Coronavirus Aid, Recovery, and Economic Security (CARES) Act.

This new $484 billion stimulus package replenishes the forgivable small business loans created under the CARES Act’s Payroll Protection Program (PPP). The law does not make any changes to the original PPP loan forgiveness criteria, as outlined in the CARES Act. Based on the speed in which the initial PPP loans were exhausted, we suggest contacting your bank immediately if you wish to apply or resubmit an earlier application.

In addition to the PPP funding, the law also supports other COVID-19 initiatives.

Small business benefits include:

- $310 billion in new funding for PPP loans

- $60 billion for additional disaster-related loans and grants

Hospital and healthcare benefits include:

- $75 billion to hospitals and healthcare providers for pandemic response and lost revenue from widespread cancellations of elective procedures

- $25 billion for COVID-19 testing, which is intended to stimulate the development, validation, manufacturing, purchasing and administration of new tests nationwide

The Waldron Rand team is closely monitoring continued legislative developments as well as the Internal Revenue Service, Small Business Administration and US Treasury’s clarifications and guidance.

We will continue to update you via email as new information is released.

Dear Clients and Friends of Waldron Rand:

The President has signed the $2 trillion CARES Act (Coronavirus Aid, Relief, and Economic Security Act) into law as one of the largest and most comprehensive relief bills in history. Many provisions in the new law apply to relief for taxpayers and businesses.

Please note that the law passed contained over 600 pages covering many different areas of the law and government. We are providing a summary of key highlights as it relates to the taxation of individuals and businesses.

Individuals

Rebates

Eligible individual taxpayers will receive a tax credit for 2020 of $1,200 ($2,400 for joint filers) along with $500 for each qualifying child. These credits will be sent out as advance payments in the form of a direct deposit or check, which will be taken as a reduction of their credit on their 2020 return. There are phaseouts of the credit based on the taxpayer’s adjusted gross income which are Single $75,000, married filing joint $150,000 and married filing separate $112,500.

Retirement plans

Taxpayers can receive distributions up to $100,000 without imposition of the 10% excise penalty for early distributions if used for purposes related to the coronavirus. The taxpayer must have been diagnosed or had a dependent who was diagnosed, or who have suffered financially as a result of being quarantined, laid-off, received a reduction in hours or may have had lost their childcare service.

Distributions can be repaid over three years. Loans from qualified retirement plans have also been increased from $50,000 to $100,000. The new law also suspends required minimum distribution rules (RMD) for the 2020 year.

Charitable contributions

The new law allows an above the line deduction of $300. The AGI limits on charitable contributions have been increased from 60% to 100% for individuals.

Net operating losses:

The new law allows a 5-year carryback for losses generated in 2018, 2019 and 2020. There is also an election to forgo the carryback. The new law also suspends the 80% limitation on NOL’s to be carried forward. The excess loss limitation ($250,000 single, $500,000 MFJ) that was enacted by the Tax Cuts and Jobs Act is now repealed.

Businesses:

Payroll taxes

The new law allows deferred payments of up to 50% of 2020 payroll taxes (employer) through 12/31/2021. The other 50% will be deferred to 12/31/2022. Self-employment taxes also have the same deferral provisions.

Refunds for payroll tax credits can also be requested in advance. This is for required paid sick leave and paid family leave credits that were recently enacted in the Families First Coronavirus Response Act that was passed into law last week.

Refundable credit for retaining employees

Eligible employers are allowed a refundable credit for 50% of qualified wages paid to each employee up to $10,000. Employers are eligible if their business was interrupted or suspended due to shutdowns ordered by a governmental authority.

Business interest limitation

For tax years 2019 and 2020, the Section 163(j) adjusted taxable income percentage has increased from 30% to 50%.

Qualified Improvement Property

The new law also makes qualified improvement property 15-year property and eligible for bonus depreciation. This is a technical correction from the Tax Cuts and Jobs Act.

Small Business Loans

Waldron Rand is counseling clients on various business loan programs included in the CARES Act. Details on these loans are as follows:

Paycheck Protection Program

There will be $350B available for expedited individual loans up to $10M through approved lenders that are guaranteed 100% by the US government. Loan proceeds can be used to cover payroll, insurance, mortgage, rent and utility payments that are incurred from 2/15/2020 through 6/30/2020.

The maximum loan equals 2.5 months of regular payroll expenses (capped at $100,000 of annual salary per employee). Borrowers are eligible for loan forgiveness equal to the amount spent on eligible costs, subject to employee retention formula. In addition, borrower and lender fees are waived, along with collateral and personal guarantee requirements. The maximum interest rate is four percent and the loan maturity can be as long as 10 years. No prepayment fees will be charged, and loan payments can be deferred for 6-12 months.

Eligible businesses include the following:

- Businesses with fewer than 500 employees.

- Small businesses as defined by the Small Business Administration (SBA) Size Standards at 13 C.F.R. 121.201.

- 501(c)(3) nonprofits, 501(c)(19) veteran’s organization, and Tribal business concern described in section 31(b)(2)(C) of the Small Business Act with not more than 500 employees.

- Hotels, motels, restaurants, and franchises with fewer than 500 employees at each physical location without regard to affiliation under 13 C.F.R. 121.103.

- Businesses that receive financial assistance from Small Business Investment Act Companies licensed under the Small Business Investment Act of 1958 without regard to affiliation under 13 C.F.R. 121.10.

- Sole proprietors and independent contractors.

Please note that the SBA is required to issue implementing regulations within 15 days and the U.S. Department of Treasury will be approving new lenders.

Economic Injury Disaster Loans

The new law also expands the types of entities eligible to receive up to $1.5 million in direct loans from the Small Business Administration and loan guarantees for substantial economic injury caused by the COVID-19 pandemic.

A substantial economic injury is defined as a business concern that is unable to meet its obligations as they mature or to pay its ordinary and necessary operating expenses.

The loan proceeds may be used for working capital necessary to carry your concern until resumption of normal operations, expenditures necessary to alleviate the specific economic injury, providing paid sick leave to employees, maintaining payroll, meeting increased costs to obtain materials, making rent or mortgage payments and repaying obligations that cannot be met due to revenue losses.

Eligible Entities:

- Any business with fewer than 500 employees.

- Tribal businesses as defined by 15 U.S.C. 657a(b)(2)(C) with fewer than 500 employees.

- Cooperatives with fewer than 500 employees.

- ESOPs as defined by 15 USC 632 with fewer than 500 employees.

- Individuals operating as a sole proprietor or an independent contractor during the covered period (January 31, 2020 to December 31, 2020).

- Small businesses as defined by the Small Business Administration Size Standards at 13 C.F.R. 121.201.

- Private non-profits with exemptions under sections 510(c), (d) or (e) of the Internal Revenue Code.

These are summaries of key tax and small business loan provisions from the new law and the eligibility and procedural requirements for some provisions are complex.

Please contact us if you have any questions.

Your Team at Waldron Rand.

The President has signed the Families First Coronavirus Act (HR 6201, the “Act”) intended to ease the economic consequences stemming from the novel coronavirus disease (COVID-19) outbreak by providing family and medical leave, and sick leave, to employees and providing tax credits to employers and to the self-employed providing the leave. The law will be effective April 2, 2020.

Family and medical leave. The Act includes the Emergency Family and Medical Leave Expansion Act (EFMLEA), which requires employers with fewer than 500 employees to provide both paid and unpaid public health emergency leave to certain employees through December 31, 2020. After 10 days of unpaid leave, the law provides 12 weeks of qualifying family and medical leave at two-thirds of their salary when employees can’t work because their minor child’s school or child care service is closed due to a public health emergency. Those on the payroll for at least 30 calendar days are eligible. Benefits are capped at $200 a day per individual (or $10,000 in total) and expire at the end of the year.

Emergency paid sick time. Under the Emergency Paid Sick Leave Act (EPSLA), private employers with fewer than 500 employees, and public employers of any size, must provide 80 hours of paid sick time to full-time employees who are unable to work (or telework) for specified virus-related reasons.The payment is capped at $511 a day per individual (or $5,110 in total) and expires at year-end.

Employer tax credits. Covered employers that are required to offer emergency FMLA or paid sick leave are eligible for refundable tax credits. The Act also provides for similar refundable credits against the self-employment tax.

Employers with fewer than 50 workers can apply for an exemption from providing paid family and medical leave and paid sick leave if it “would jeopardize the viability of the business.”

The most efficient method of delivery of tax information is via our secure email server (Zix) or our secure portal. Please contact sarahd@waldronrand.com if you need any assistance with either method. You can still send packages to us via regular mail as well, but please be aware that this will likely result in a delay in when we can begin working on your return.

Dear Clients and Friends,

The coronavirus has far reaching impact. We are anticipating an extension of the April 15th deadline. At this time, the IRS has not made a ruling. As we receive updates, we will keep you informed via email.

It is important that we keep our team safe, healthy and productive. Therefore, we have moved to a virtual work environment. Most team members are working from their homes, using computers which link to our Virtual Private Network (VPN), the same secure platform we use in our offices.

We are here to help and serve you. You can reach us via email or by calling our main line at (781)449-5825 and, if nobody is able to answer the phone, you can use our dial by name directory to leave a voicemail in the appropriate inbox. You can also find a staff directory on our website. There you will find individual emails for each team member.

We do anticipate our office will remain open, with limited staff, at most times. That said, we encourage electronic delivery of your tax information, if possible. Otherwise, please feel free to come by the office to drop anything off. If there is nobody in the office at that time, please note that we have a secure drop box outside of our back entrance, which we will check frequently.

The influence of COVID-19 is evolving. As we learn more from the IRS, we will keep you informed via emails.

In December 2019, Congress passed—and the President signed into law—the Setting Every Community Up for Retirement Enhancement (SECURE) Act. The SECURE Act is landmark legislation that may affect how you plan for your retirement. Many of the provisions go into effect in 2020, which means now is the time to consider how these new rules may affect your tax and retirement planning situation.